maryland student loan tax credit application 2021

For any tax year the sum of all Endow Maryland tax credits including any carryover credits may not exceed the lesser of 50000 or the total amount of tax otherwise payable by the individual. OneStop is the central hub for Maryland State licenses forms certificates permits applications and registrations.

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Ad With Multi-Year Approval you could fund your entire college experience.

. FromJuly 1 2022 through September 15 2022. This application and the related instructions are for. If the credit is more than the taxes you would otherwise owe you will receive a.

It was founded in 2000 and is an active participant in the American Fair. Adjust To Fit Your Schedule And Budget. Marylandtaxpayers who have incurred at least 20000 in undergraduate andor.

Complete Edit or Print Tax Forms Instantly. Ad With Multi-Year Approval you could fund your entire college experience. Complete the Student Loan Debt Relief Tax Credit application.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions. CuraDebt is a debt relief company from Hollywood Florida.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

Eligible applicants are Maryland Tax Payers in 2021 who have incurred at least. 2021 Homeowners Property Tax Credit Application HTC-1 Form Filing Deadline October 1 2021 Apply online. Ad Access IRS Tax Forms.

Welcome to the Maryland OneStop Portal. Httpwwwtaxcreditssdatmarylandgov HTC-1 v10 Page 1 of 4. Complete the Student Loan Debt Relief Tax Credit application.

It was established in. Adjust To Fit Your Schedule And Budget. Who may apply.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Student Loan Tax Credit Application The Deadline for the Student Loan Debt Relief Tax Credit is September 15. About the Company Student Loan Debt Relief Tax Credit Application Maryland Resident.

Learn How Differences In Rate Repayments Add Up. Student Loan Debt Relief Tax Credit Application. To be eligible you must claim Maryland residency for the 2021 tax year file 2021 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate.

To be eligible you must claim maryland residency for the 2021 tax year file 2021 maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. Include the Supporting Documentation listed. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

About the Company Maryland Property Tax Relief. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. The Student Loan Debt Relief Tax Credit is a.

CuraDebt is a company that provides debt relief from Hollywood Florida. Learn How Differences In Rate Repayments Add Up. For Maryland Resident Part-year Resident Individuals Tax Year.

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of. Student Loan Debt Relief Tax Credit Program. The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025.

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit Schedule 8812 H R Block

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Child Tax Credit Update How To Change Your Bank Info Online Money

Learn How The Student Loan Interest Deduction Works

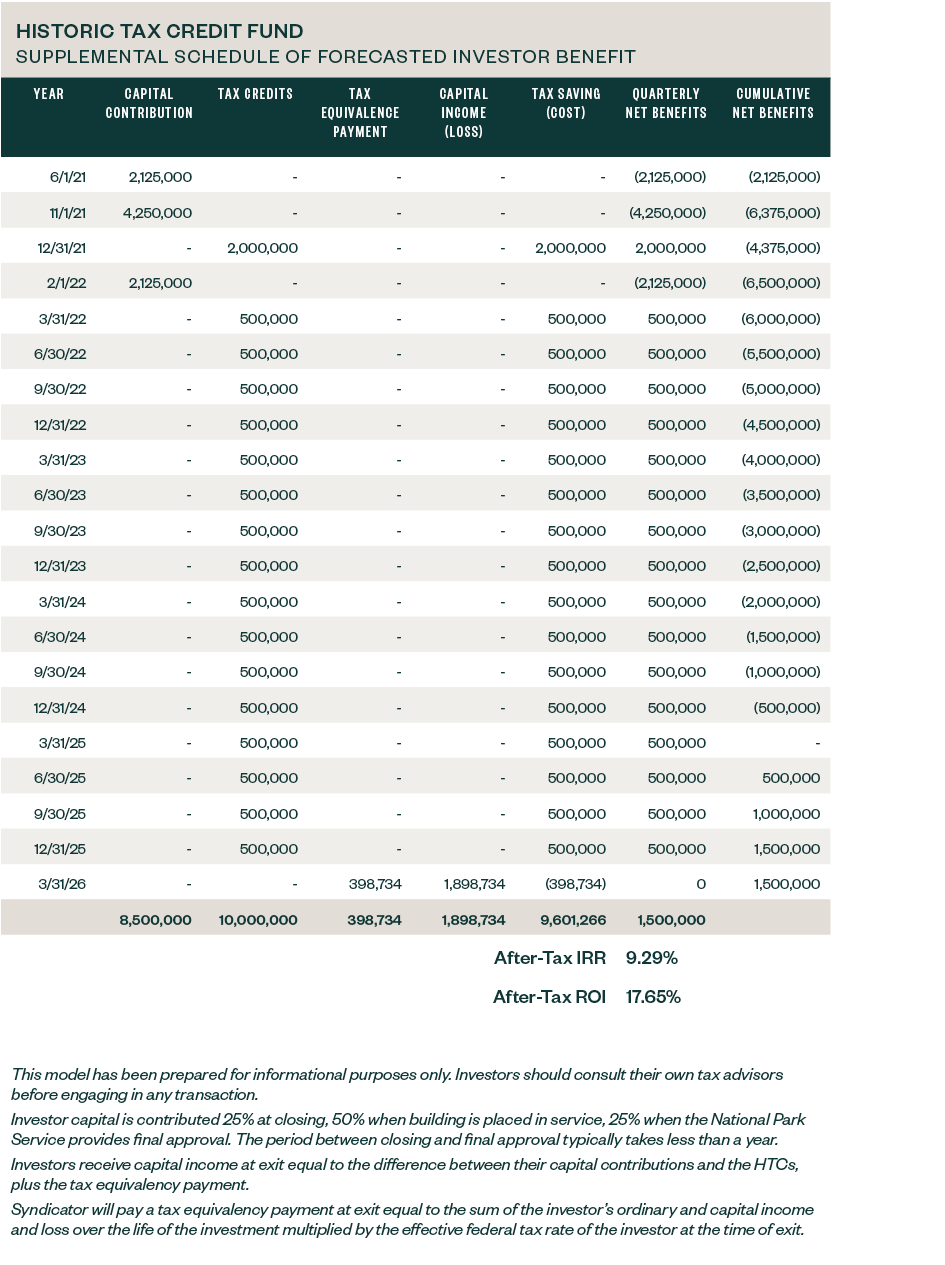

How To Acquire Federal Tax Credit Investments

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

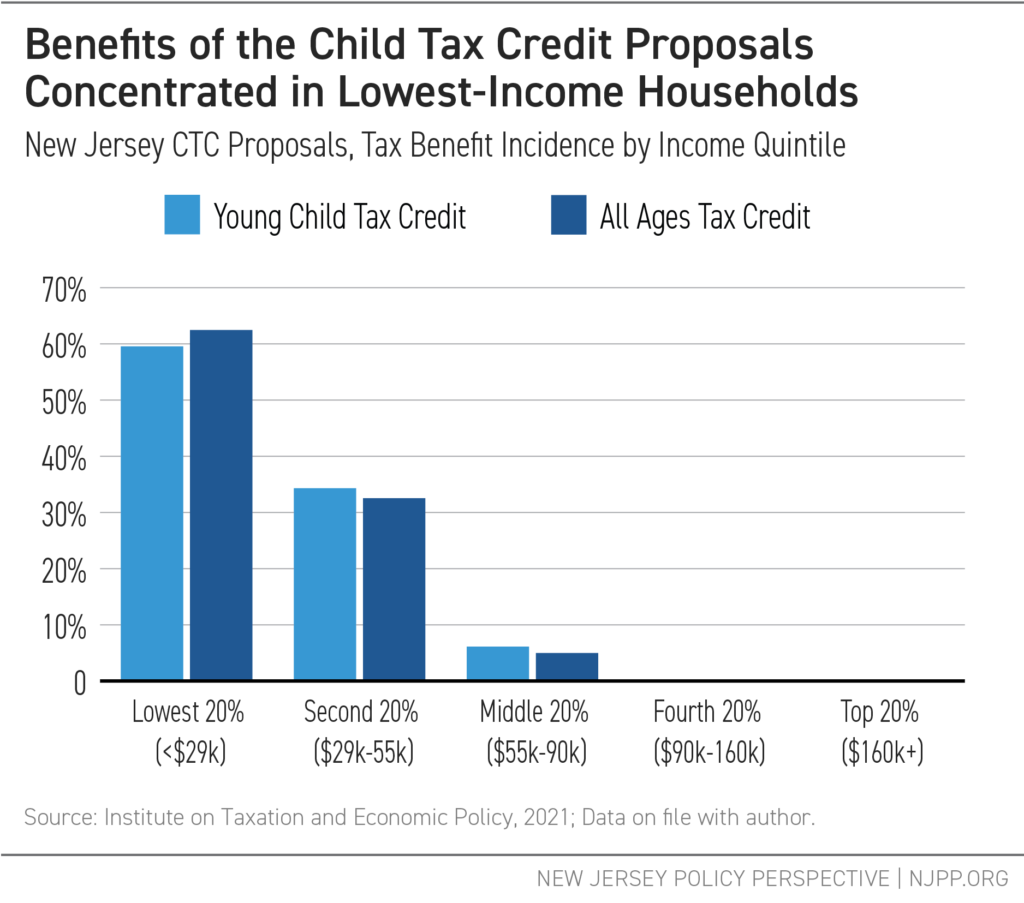

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

American Opportunity Tax Credit H R Block

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

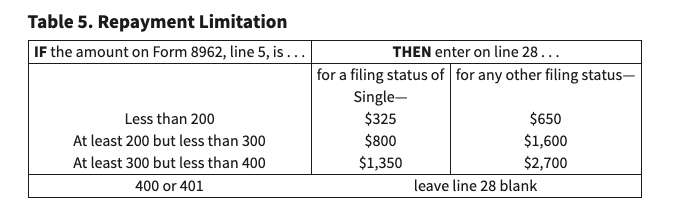

Advanced Tax Credit Repayment Limits

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Tax Credit 2022 How Much Is The Child Support In These 10 States Marca

Earned Income Tax Credit Now Available To Seniors Without Dependents

Maryland Homecredit Program Lender Information

Child Tax Credit Here S When You Ll Get The August Payment Cbs News